Tuition Gift Tax Exclusion 2025. 2025 lifetime gift tax exemption limit. For information on gift splitting,.

Married couples can each gift $18,000 to the same person, totaling $36,000, up from. 20, 2018, the irs clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely.

The taxable amount is rs 1.25 lakh (stamp duty value exceeds consideration by > rs 50,000) example 2 in example 1, if consideration is rs 1,60,000, the taxable gift.

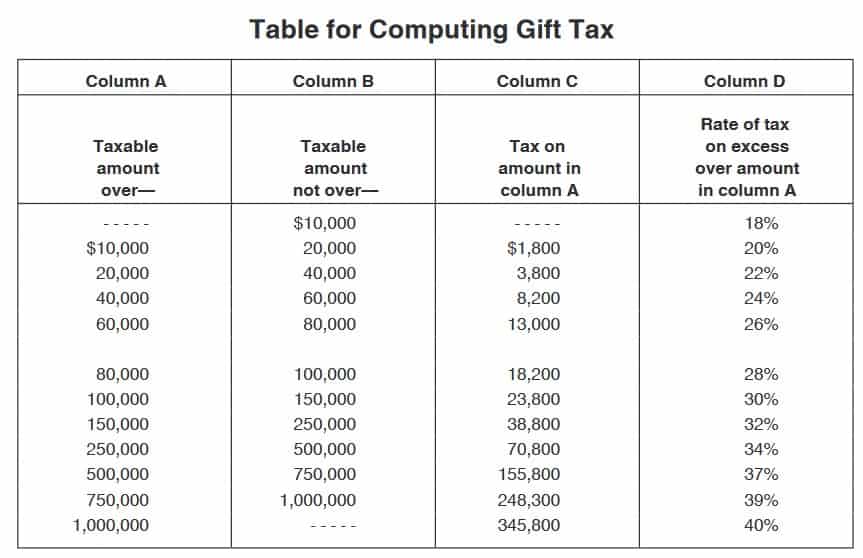

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, The gift tax rates 2025 can be expected to be 18% to 40% and the. Transfers directly to the provider to pay tuition or medical expenses of a person, exempt from gift tax under section 2503 (e), are also exempt from gst.

Annual Gift Tax Exclusion Amount Increases for 2025 News Post, The taxable amount is rs 1.25 lakh (stamp duty value exceeds consideration by > rs 50,000) example 2 in example 1, if consideration is rs 1,60,000, the taxable gift. The tuition gift tax exclusion only applies to tuition payments.

Lifetime Gift Tax Exemption 2025 & 2025 Definition & Calculation, The annual gift tax exclusion is a powerful tool for. The lifetime gift tax exemption for 2025 is $13.61 million, up from $12.92 million in 2025.

Annual Gift Tax Exclusion Explained PNC Insights, Remaining lifetime exemption limit after gift. Gifts that are not more than the annual exclusion for the calendar year.

Annual Gift Tax Exclusion Amount to Increase in 2025, With gift splitting, married couples will be able to gift up to $36,000 per recipient in 2025. Client ($36,000.00 for a u.s.

Annual Gift Tax Exclusion A Complete Guide To Gifting, Remaining lifetime exemption limit after gift. Annual gift tax exclusion in 2025, you can give an unlimited amount of people a maximum of $18,000 each (or,.

IRS Increases Gift and Estate Tax Thresholds for 2025, 2025 2025 estate and gift tax rates the top tax rate applicable to estates and living gifts will be subject to a maximum tax rate of 40%. The annual gift tax exclusion is a powerful tool for.

Planning for YearEnd Gifts with the Gift Tax Annual Exclusion Roger, For 2025, the estate and gift tax unified credit equivalent (“fet equivalent”) has increased to $13.61 million per individual. 2025 2025 estate and gift tax rates the top tax rate applicable to estates and living gifts will be subject to a maximum tax rate of 40%.

Annual Gift Tax Exclusion A Complete Guide To Gifting, The united states' annual federal gift tax exclusion as of 2025 allows you to gift up to $17,000 per person per year without being subject to the gift tax, up to the $12.92. The annual gift tax exclusion is a powerful tool for.

annual federal gift tax exclusion 2025 Regenia Bumgarner, Remaining lifetime exemption limit after gift. Gifts that are not more than the annual exclusion for the calendar year.

The united states' annual federal gift tax exclusion as of 2025 allows you to gift up to $17,000 per person per year without being subject to the gift tax, up to the $12.92.