How Much Is Inheritance Tax In Pa 2025. The state imposes an inheritance tax on the value of a deceased person’s estate transferred to their heirs. To start, you won’t have to pay any federal estate tax unless the total assets you’ve inherited are worth more than $12.92 million in 2025 (the amount is double for a.

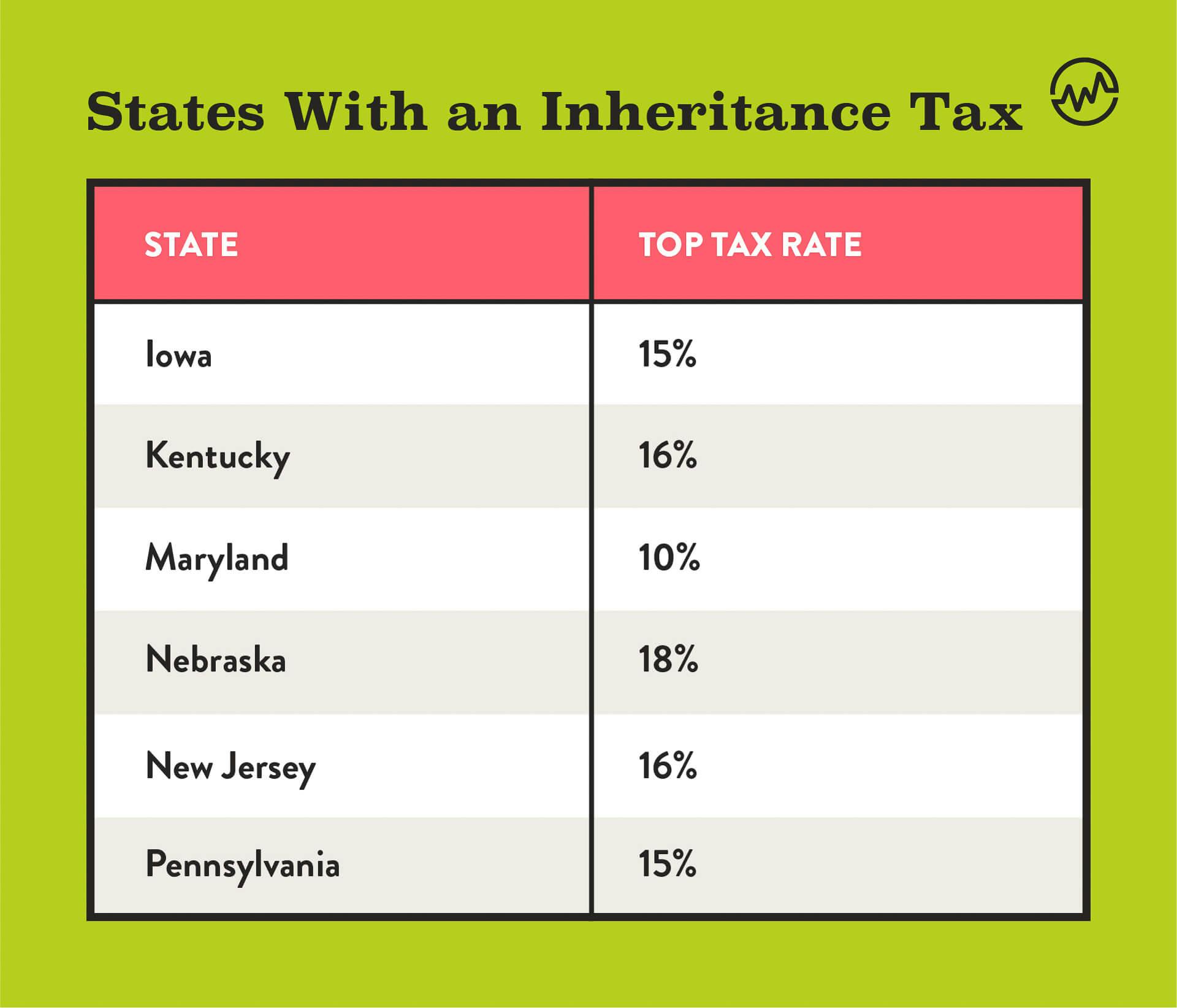

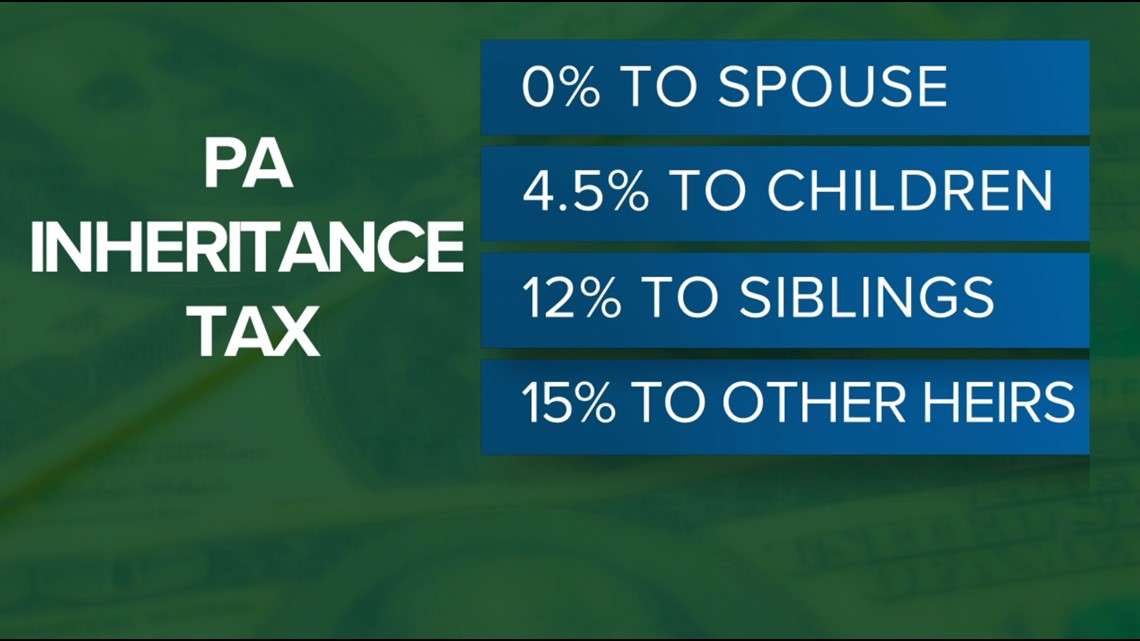

Sometimes an inheritance tax is used. Pennsylvania levies an inheritance tax on assets transferred to heirs based on their relationship to the deceased as follows;

The amount of tax a beneficiary pays depends on the value of the.

The state imposes an inheritance tax on the value of a deceased person’s estate transferred to their heirs.

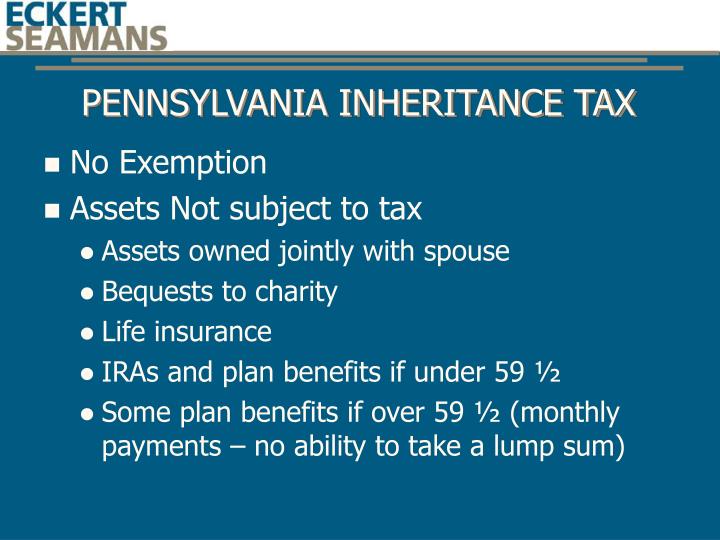

Estate & Gift Tax Considerations, This means that with the right legal maneuvering a. Pennsylvania inheritance tax is due within 9 months of a person’s date of death on the value of most assets owned by the decedent and passed on to his or her beneficiaries.

Inheritance Tax How Much Will Your Children Get? Your Estate Tax, Labour has pledged to kickstart economic growth. Most immediate family members pay 4.5% inheritance tax on the property they inherit.

Pennsylvania Inheritance Tax LOOK OUT BELOW! YouTube, For the financial year that concluded on 31 march 2025, the deadline for individuals to submit their income tax returns (itrs) is on july 31, 2025. The inheritance tax rate depends on the beneficiary’s relationship to the deceased and the inheritance amount.

Pennsylvania Inheritance Tax Forms 2025 2025, The federal estate tax exemption is $13.61 million in 2025 and $12.92 million in 2025. Approximately £825m of this is paid by millions of adults with health insurance each year, according to analysis by accountancy firm rsm, who estimate that increasing.

Pennsylvania Tax Calculator 2025 Berta Celinka, For the financial year that concluded on 31 march 2025, the deadline for individuals to submit their income tax returns (itrs) is on july 31, 2025. Inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries.

Inheritance Tax DBW Tax Services, LLC, The inheritance tax rate depends on the beneficiary’s relationship to the deceased and the inheritance amount. Inheritance tax is imposed as a percentage of the value of a decedent’s estate transferred to.

PPT ESTATE AND GIFT TAX SELECTED OVERVIEW PLUS REFORM? OR, Receiving an inheritance often prompts questions about tax liabilities. Depending on where the person who died lived, how much the assets are worth and how close you were to the deceased person, you may have to pay an.

Inheritance Tax How Much Will Your Children Get? Your Estate Tax, The inheritance tax rate depends on the beneficiary’s relationship to the deceased and the inheritance amount. Receiving an inheritance often prompts questions about tax liabilities.

Who Can Receive an Inheritance Tax Refund in Pennsylvania?, Whether india needs to impose an estate tax is a matter of debate and depends on various economic, social and political factors. The amount of tax a beneficiary pays depends on the value of the.

Pennsylvania among just six states that still have an inheritance tax, According to the pennsylvania department of revenue, the state has brought in $1.4 billion in inheritance tax revenue this fiscal year, which is $137.4 million, or 11.2. The tax rate for pennsylvania.

Most immediate family members pay 4.5% inheritance tax on the property they inherit.