Cra Travel Allowance 2025. Changes to the mileage rate for 2025. As we show you the simple calculations that will help you work out your mileage reimbursement, we are using the 2025 cra automobile allowance rates.

The cra considers personal travel between an employee's residence and regular place of employment (rpe) as taxable.

StepByStep How To Claim Motor Vehicle Expenses From The CRA, For the territories, 74 cents per km for the first 5,000 kilometres driven, and 68 cents for each additional kilometre. The updated form t2200 is.

CRA Mileage Rate 2025 All You Should Know about Medical Travel Allowance, The 2025 cra mileage rate in alberta is set to 70 cents per kilometer for the first 5,000. You are the primary beneficiary of.

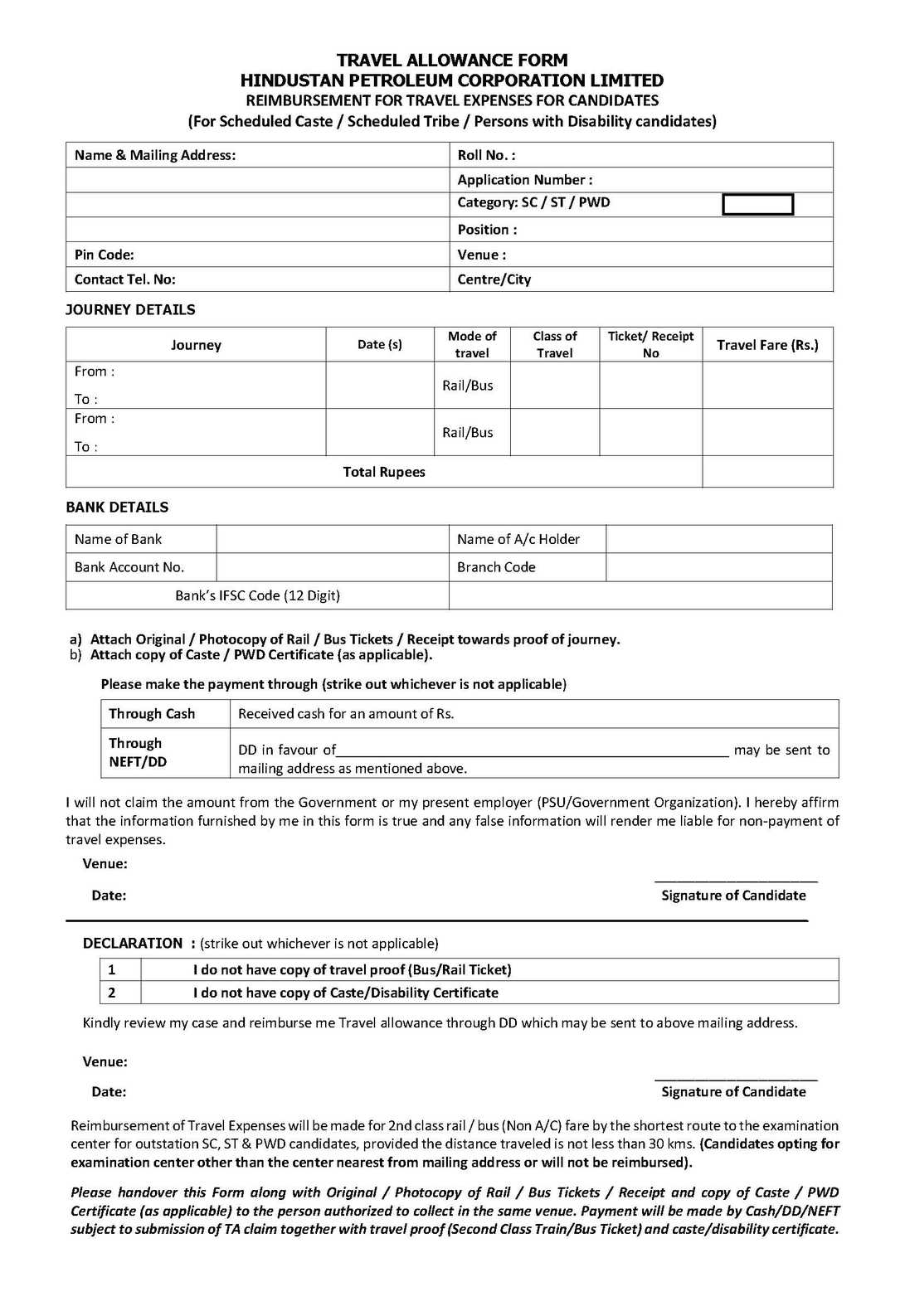

Travel Allowance Form For HPCL 2025 2025 EduVark, The cra announces 2025 rates for vehicle allowance: From january 1st, 2025, per kilometre rates will increase 2 cents over 2025.

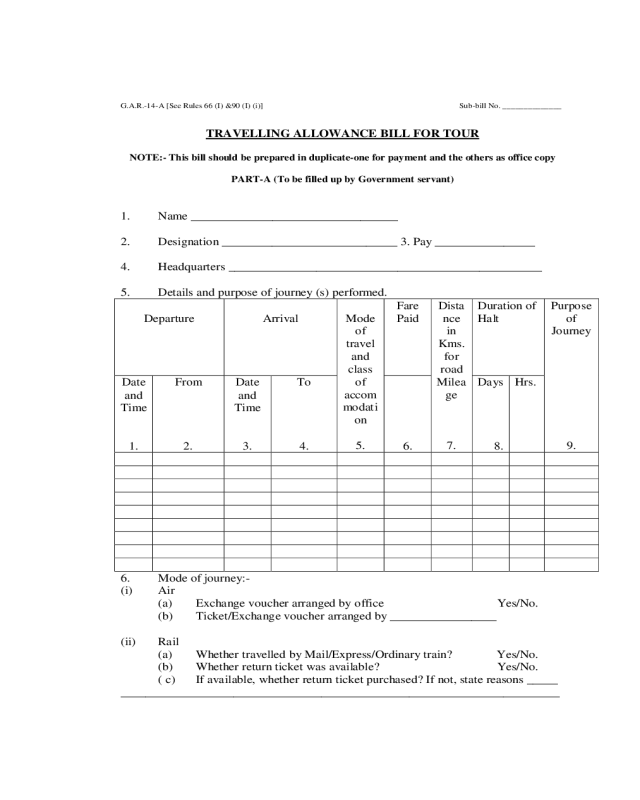

2025 Travelling Allowance Form Fillable, Printable PDF & Forms Handypdf, For the territories, 74 cents per km for the first 5,000 kilometres driven, and 68 cents for each additional kilometre. The cra generally considers a value of up to $23 for the meal portion of the travel allowance to be reasonable;

How to claim CRA medical travel expenses for 2025, Faq what is the 2025 cra mileage rate in alberta? But what is an rpe in this era of remote.

The Prescribed Travel Rate per KM increases and the Determined Travel, Per diem allowance refers to the daily allowance given to employees on overseas trips (i.e. See our dedicated article on the cra mileage.

Leave Travel Allowance (LTA) Claim Rule, Eligibility, Tax Exemptions, See our dedicated article on the cra mileage. The northwest territories, yukon, and.

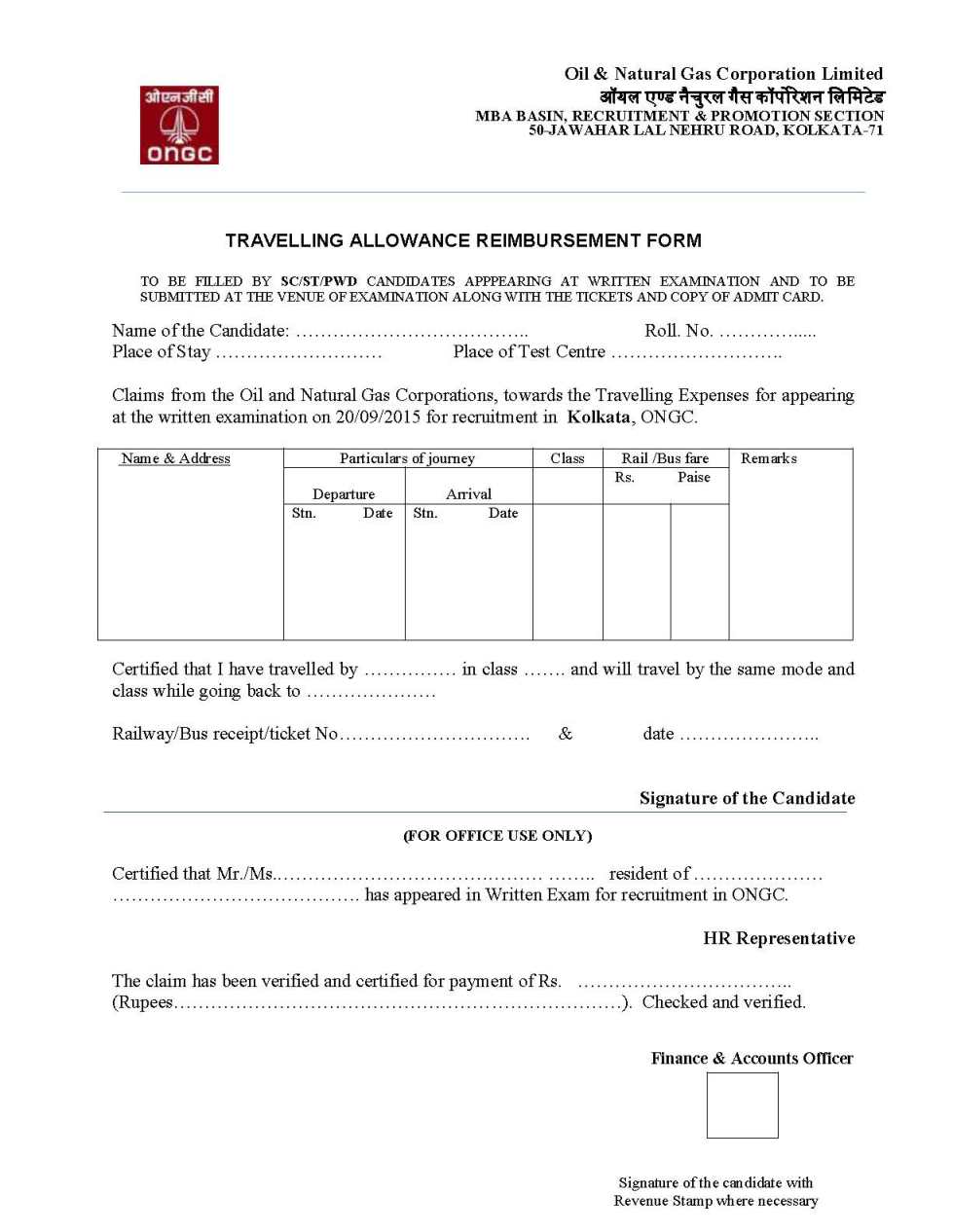

ONGC Travel Allowance Form 2025 2025 EduVark, You had to include in your income (in the same year you have the travel expenses) the taxable travel benefits that you received from your employment in a prescribed zone. Changes to the mileage rate for 2025.

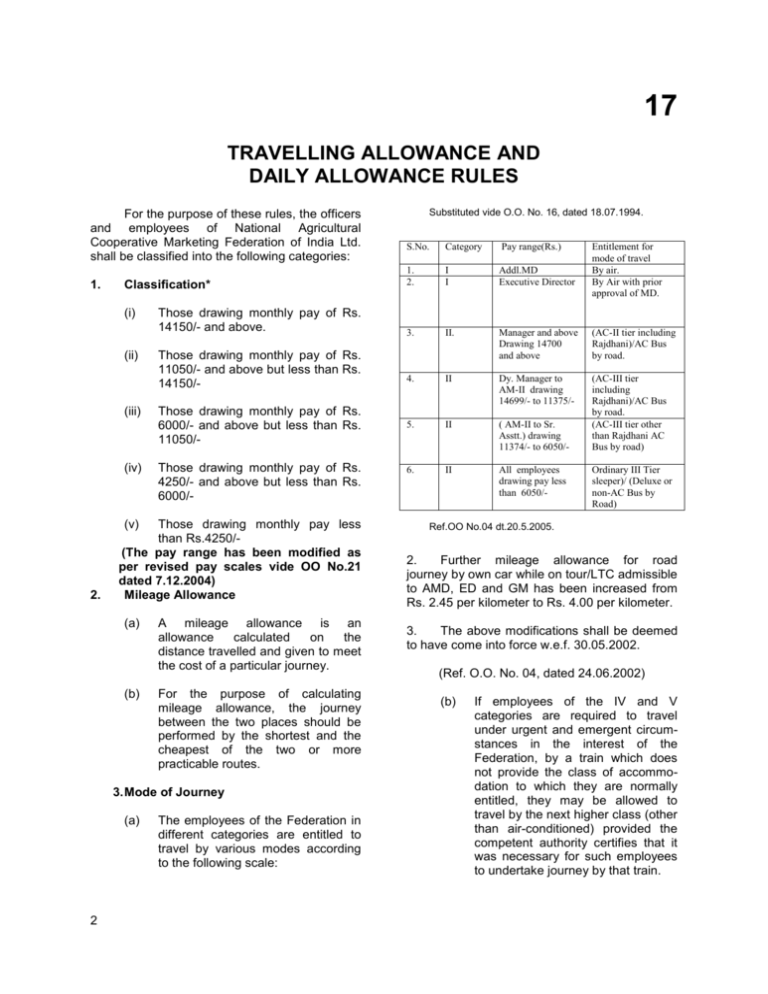

17. Travelling Allowance and Daily Allowance Rules, As we show you the simple calculations that will help you work out your mileage reimbursement, we are using the 2025 cra automobile allowance rates. Cra’s 2025 automobile allowance rates for all provinces:

2025 Travelling Allowance Form Fillable, Printable PDF & Forms Handypdf, Faq what is the 2025 cra mileage rate in alberta? Changes to the mileage rate for 2025.